Acume. Bringing Automation to Financial Chaos.

Secure, cloud-based financial processing from as little as $60 per month!*

What is Acume?

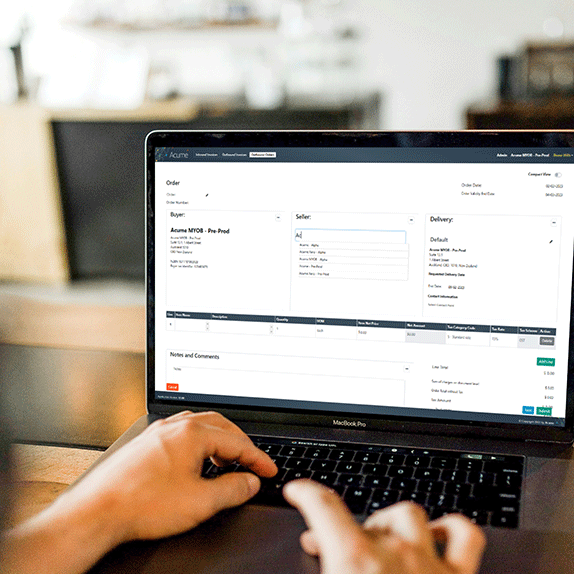

As a trusted technology partner for New Zealand and Australian businesses, Sharp brings you Acume—a secure, AI-driven accounts payable and receivable platform designed to transform your finance operations.

Starting from just $60 per month, Acume streamlines financial automation with features like Peppol e-Invoicing, PDF data extraction, and workflow approvals. Purpose-built for finance teams, it enables end-to-end automation that can save up to 30% of your team’s time.

Seamlessly integrating with leading platforms including Xero, MYOB, SAP Business One, Microsoft Dynamics 365, and Abel, Acume gives you the power to simplify and scale your finance processes.

Benefits of Acume for Your Business

Deep expertise in AU/NZ finance operations.

Rapid deployment, improving productivity.

Built-in approvals reducing processing times.

Secure, systematic, compliant and scalable.

E-Invoicing

Sends and receives invoices via Peppol-compliant digital network.

Accounts Payable

Processes PDFs and eInvoices through one configurable approval workflow.

Accounts Receivable

Automates high volume billing, invoice capture, validation, and approval workflows.

Supplier Statement Reconciliations

Matches supplier statements received for processing with invoices to find discrepancies.

Inboind & Outbound Purchase Orders

Extracts Item IDs to import, raise and approve POs and receipts to and from suppliers.

Expense Claims

Automates employee expense submissions and approval processing.

Why Finance Professionals Trust Acume

Acume streamlines your Order-to-Cash and Procure-to-Pay processes by automating key steps such as:

- eInvoicing and PDF invoice extraction in a single workflow.

- Automated matching of supplier statements and purchase orders.

- Bank feed integration for seamless receivables processing.

- General ledger coding at header or line level for accurate cost allocation.

With Acume, finance teams can:

- Reduce manual errors and double-handling.

- Accelerate invoice processing times.

- Improve cash flow visibility.

- Ensure compliance with local and international standards.

Our Plans

All plans include connection to a Peppol Access Point, online support and the freedom to cancel at any time.

*All prices are in NZD and exclude GST

**Additional rates apply for volumes consumed above the monthly allotment.

- 25 Outbound Invoices included**

- 25 Inbound Invoices included**

- 25 Outbound Invoices included**

Reconciliation- Workflow

- Approvals

- Xero Integration

- MYOB Integration

Custom Integration/s

- Unlimited Outbound invoices

- Unlimited Inbound invoices

- Unlimited Outbound Orders

- Reconciliation

- Workflow

- Approvals

- Xero Integration

- MYOB Integration

- Custom Integration/s

“The system’s accuracy in capturing and recording invoice data has been impressive, reducing errors and ensuring prompt payments. This efficiency has saved us valuable time and enhanced our overall financial management.”

— Li Tye, Financial Controller, Tyres4U

Frequently Asked Questions

What invoice formats can Acume process in Accounts Payable workflows?

Acume processes both PDF and Peppol eInvoices through a unified, configurable workflow, applying the same coding, validation, and approval rules regardless of the format.

Why use Acume for Peppol eInvoicing instead of a third-party tool?

Acume is MBIE-certified eIvoicing-ready software, which means you can send and receive eInvoices via Acume. (We'll assist you in the right eInvoicing adoption for your business).

How are supplier statement reconciliations automated in Acume?

Any mismatches, missing invoices, or duplicates are flagged, with a clear audit trail for resolution. Supplier statements are automatically matched against invoices that have been received in Acume.

What purchase order capabilities does Acume support?

Acume can process inbound customer orders to support sales order creation. On the supplier payables side, Acume can import POs from your ERP or jobbing system for matching to Invoices, or you can create, send and then receive Purchase Orders for your suppliers from Acume.

What data capture technologies power Acume’s invoice and document processing?

Acume uses AI, OCR, and proprietary rules engines to extract and normalise data from PDFs, scanned documents, Excel files, and Peppol eInvoices.

Can approval workflows be customised across business units?

Yes. Acume allows flexible, multi-level approval routing based on business unit, entity, cost centre, amount thresholds, or GL coding rules.

Which ERP systems do Acume integrate with out of the box?

Acume integrates with Xero, MYOB, Abel, Costar and others, using API, file-based, or hybrid integration depending on client architecture. Get in touch with us to discuss your connection requirements.

Case Studies

Find out how National Tyre and Wheel Pty Ltd, was undergoing a digital transformation and needed to migrate to a new accounting software system, and Acume was able to offer a minimum viable product (MVP) portal within a month!

Find out how Spraymarks, a leading provider of road safety solutions in New Zealand and part of a group using Xero, faced inefficiencies in managing intercompany billing and supplier invoices, see how Aucme helped.

As a part of National Tyre & Wheel Limited, Tyres4U offer a vast array of tyre solutions for commercial vehicles to earthmovers. As they scaled, managing accounts payable became overwhelming and Acume helped.

Found what you're looking for?

Search our website for products, FAQs, software and drivers here...